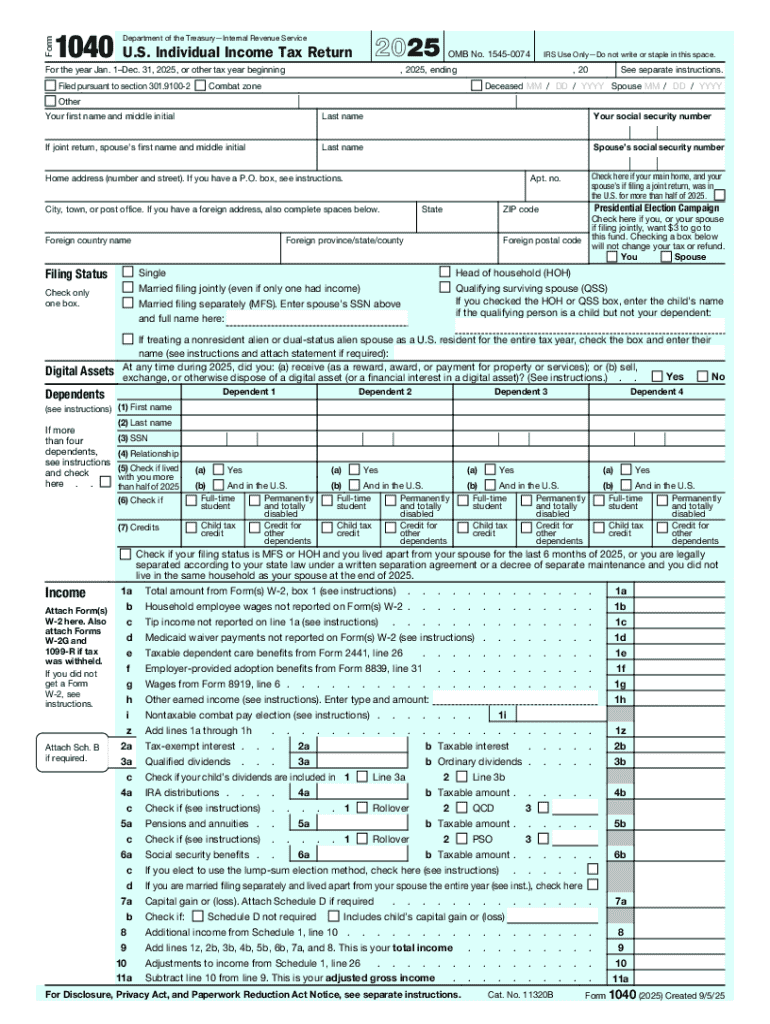

IRS 1040 2025-2026 free printable template

Instructions and Help about IRS 1040

How to edit IRS 1040

How to fill out IRS 1040

Latest updates to IRS 1040

All You Need to Know About IRS 1040

What is IRS 1040?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Is the form accompanied by other forms?

FAQ about IRS 1040

What should I do if I need to correct an error on my IRS 1040 after filing?

To correct an error on your IRS 1040, you should file an amended tax return using Form 1040-X. This form allows you to correct mistakes in your original submission, whether they relate to income, deductions, or credits. Ensure you document the changes clearly and submit your amended return as soon as possible to minimize any potential penalties.

How can I check the status of my IRS 1040 filing?

You can check the status of your IRS 1040 filing through the IRS website using their 'Where's My Refund?' tool. This service allows you to track your refund status by entering your Social Security number, filing status, and exact refund amount. It’s a reliable way to verify receipt and processing of your return.

What common errors should I avoid when filing the IRS 1040?

Common errors when filing the IRS 1040 include incorrect Social Security numbers, mismatched names, and mathematical mistakes. To avoid these issues, double-check all personal information and calculations. Additionally, consider using tax software that can help identify potential errors before submission.

Are electronic signatures accepted on the IRS 1040?

Yes, electronic signatures are accepted on the IRS 1040 when filing electronically. This method simplifies the process, making it faster and more efficient than traditional signatures. Ensure you follow the guidelines provided by the IRS for e-signing to ensure compliance.

What should I do if I receive a notice regarding my IRS 1040 after filing?

If you receive a notice regarding your IRS 1040 after filing, carefully read the communication to understand the IRS's inquiry or request. It is important to respond promptly with any required documentation or information to address the issue raised. Keeping detailed records will aid in your response.

See what our users say